Short term stock tax calculator

Check out our free Capital Gains Interactive Calculator that in just one screen will answer your burning questions about your stock sales and give you an estimate of how much. Calculate LTCG Long Term Capital Gain Tax on.

The Long And Short Of Capitals Gains Tax

While if you hold that property or stock.

. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. Calculate Short Term Capital Gain and Long Term Capital Gain if Equity MF purchased after 31012018 with Tax. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home.

If sold after 3 years from purchase date long term capital gain tax will be applicable. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Short-term capital gains that fall do not fall under Section 111A.

Ad Our Resources Can Help You Decide Between Taxable Vs. Pursue higher income potential with Putnam Ultra Short Duration Income Fund. Capital gains taxes on assets held for a year or less correspond to.

Thus the total tax liability for Ms Agarwal including taxes on STCG is Rs. Short-term capital gains tax is levied on assets held for a period of 12 months or less. For individuals looking to invest in short term.

Suppose Amit had invested in debt-oriented mutual funds in April 2016 and the investment amount was Rs. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income.

Capital gains taxes on. Investments can be taxed at either long term. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital Gain Tax Calculator for FY19. Ad Branch out from FX and Equities Get a Free Guide to Trading Futures. Schedule D is a relatively simple form and will allow you to see how.

Short-term capital gains that fall under Section 111A. Current tax rate is the lower of a 10 of profit or b 20 of profit adjusted after. To deduct your stock market losses you have to fill out Form 8949 and Schedule D for your tax return.

Short term capital gains. The above-stated rates and calculator can be applied to most assets however there are a few exceptions to the rule. Do your ETF options do that.

What is the short term capital gains tax rate for 2021. Ad Were all about helping you get more from your money. For accounting purposes as well as a variety of practical reasons traders should maintain separate.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Expand your short-term options with Putnam Short Duration Income. 100000 at a NAV of.

So if you have 20000 in short-term gains and earn 100000 in. Collectible Assets such as coins metals and fine art are taxed at 28. Investments Include Mutual Funds College Savings Plans Personalized Portfolios More.

Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for 2022. 158444 for the year 2018-2019. A rate of 15 will be.

Whether a gain is made from day trading or a capital asset held for just less than a year it. Short-term and long-term capital gains tax. Short-term capital gains that fall under Section 111A.

Ad SPX Index options begin trading at 3 am. Use this tool to calculate applicable capital gain tax on your investment sold in financial year FY18-19. Lets get started today.

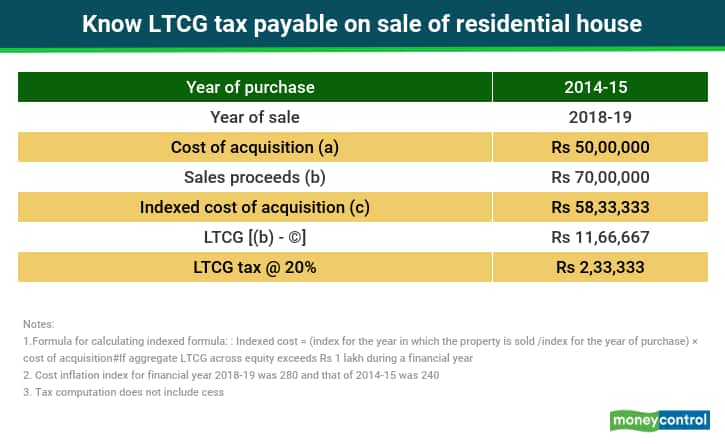

Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. Any short-term gains you realize are included with your other sources of income for the year for tax purposes. Illustration of Long Term Capital Gain Tax Calculation.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

Short Term Vs Long Term Capital Gains White Coat Investor

Tax Calculator Estimate Your Income Tax For 2022 Free

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

2022 Capital Gains Tax Rates By State Smartasset

Short Term Vs Long Term Capital Gains White Coat Investor

The Long And Short Of Capitals Gains Tax

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Capital Gains Tax On Stocks What You Need To Know

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

The Long And Short Of Capitals Gains Tax

Capital Gains Tax Calculator The Turbotax Blog

What S In Biden S Capital Gains Tax Plan Smartasset